U.S. Stock Market Summary for Tuesday, April 22, 2025

Major Indices

-

S&P 500: +2.5% to 5,287.76

-

Dow Jones Industrial Average: +2.7% to 39,186.98

-

Nasdaq 100: +2.63% to 18,276.41

-

Russell 2000: +2.7% to 1,890.28

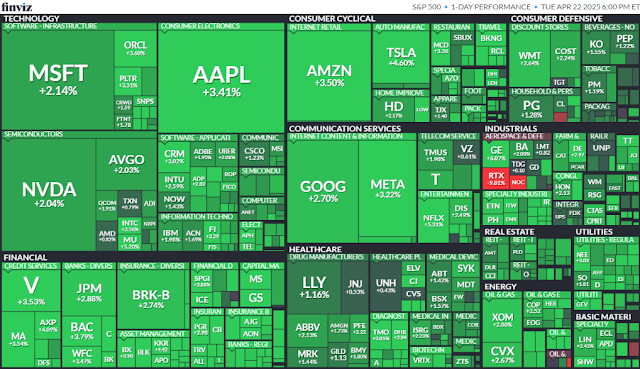

Market Overview

U.S. equities rallied on Tuesday, with major indices surging over 2% amid a broad-based recovery fueled by upbeat corporate earnings and renewed optimism on trade. Treasury Secretary Scott Bessent's remarks hinting at progress in U.S.-China trade negotiations provided a tailwind to investor sentiment, helping markets bounce back from recent losses. Strong performance in large-cap and technology stocks further reinforced the day's bullish tone.

Sector Highlights

-

Equifax (EFX) surged 13.8% following a stellar Q1 earnings report, a dividend hike, and a $3 billion stock buyback announcement.

-

First Solar (FSLR) jumped 10.5% after the U.S. government imposed strict antidumping duties on solar imports from Southeast Asia.

-

Pentair (PNR) climbed 9.2%, outperforming despite declining revenue, highlighting strong margin control and strategic resilience.

-

Northrop Grumman (NOC) tumbled 12.7% due to a disappointing earnings miss and escalating cost issues in its B-21 bomber program.

-

Halliburton (HAL) dropped 5.6% amid falling oilfield activity and tariff-related headwinds.

-

Kimberly-Clark (KMB) slipped 1.5% after cutting its 2025 profit forecast, citing $300 million in additional tariff-related costs.

Economic Snapshot

The International Monetary Fund (IMF) downgraded its global growth projection for 2025 to 2.8%, citing widespread economic strain from newly implemented U.S. tariffs. The IMF also raised the probability of a U.S. recession to nearly 40% and trimmed its U.S. GDP growth forecast to 1.8%. Inflation is now expected to climb to around 3% this year.

Expert Commentary

Ryan Detrick of Carson Group commented, "Some thawing of the aggression between the U.S. and China, thanks to Bessent’s comments, helped push things higher." Meanwhile, Barclays analysts expressed cautious optimism for the tech sector, noting that historically, it has delivered over 30% gains in the year following bear market recoveries, positioning mega-cap names like Nvidia as potential leaders once trade tensions ease.

Government & Political Notes

President Donald Trump intensified his rhetoric against Federal Reserve Chair Jerome Powell, labeling him a "major loser" while calling for interest rate cuts—comments that stoked concerns about the Fed’s independence. In addition, his sweeping new tariffs have triggered significant economic fallout, according to the IMF, which warns of elevated inflation and weakened growth resulting from these protectionist policies.

Conclusion

Tuesday's robust rally underscored growing investor confidence in corporate fundamentals and the potential for easing geopolitical tensions. However, the persistence of aggressive trade policies and political pressure on monetary authorities continue to cloud the longer-term outlook. Volatility may remain elevated as markets weigh economic resilience against policy risks.